Korea’s OOH Market in 2025, Growth Under Pressure, Bigger Digital Screens and Battle for Measurement

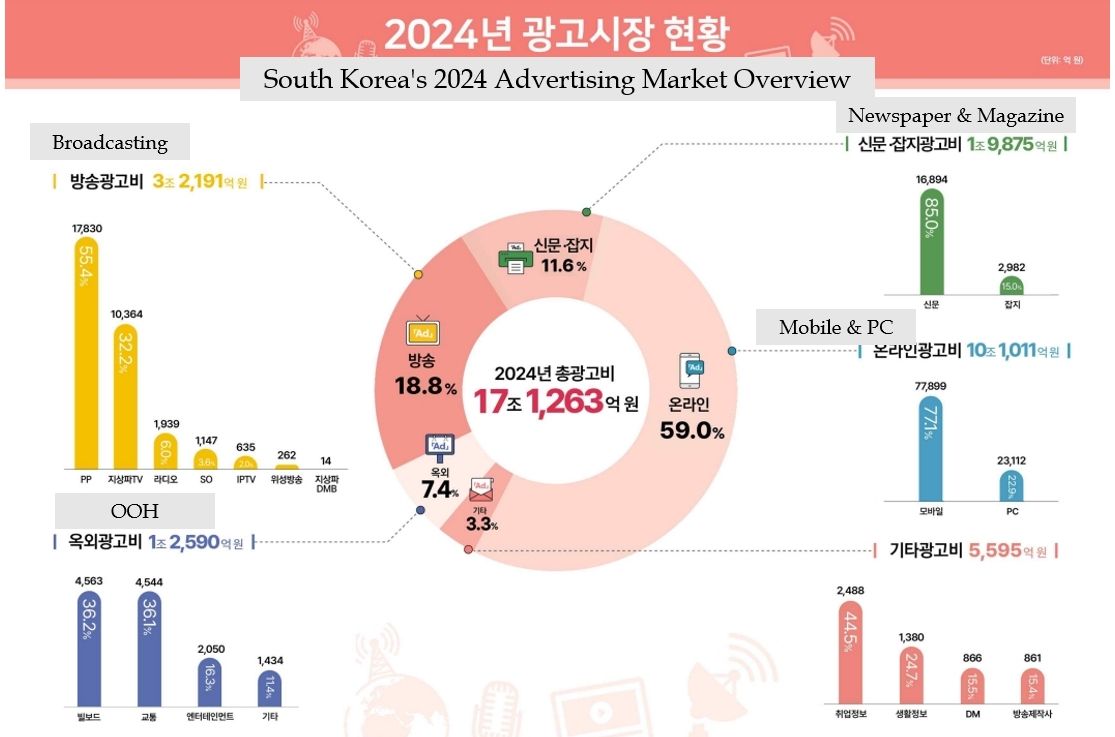

South Korea’s advertising market entered 2025 with modest but meaningful growth, providing important context for the evolution of out-of-home (OOH) media. According to the latest “2025 Broadcast and Telecommunications Advertising Expenditure Survey” released by the Korea Communications Commission and the Korea Broadcast Advertising Corporation, total advertising spending in 2024 reached KRW 17.13 trillion, equivalent to about 0.75% of GDP and up 3.5% year on year.

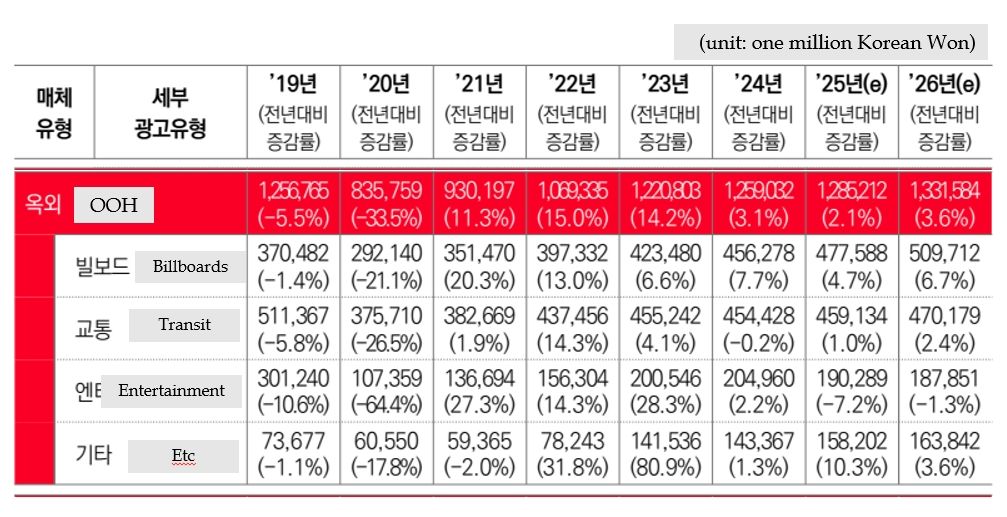

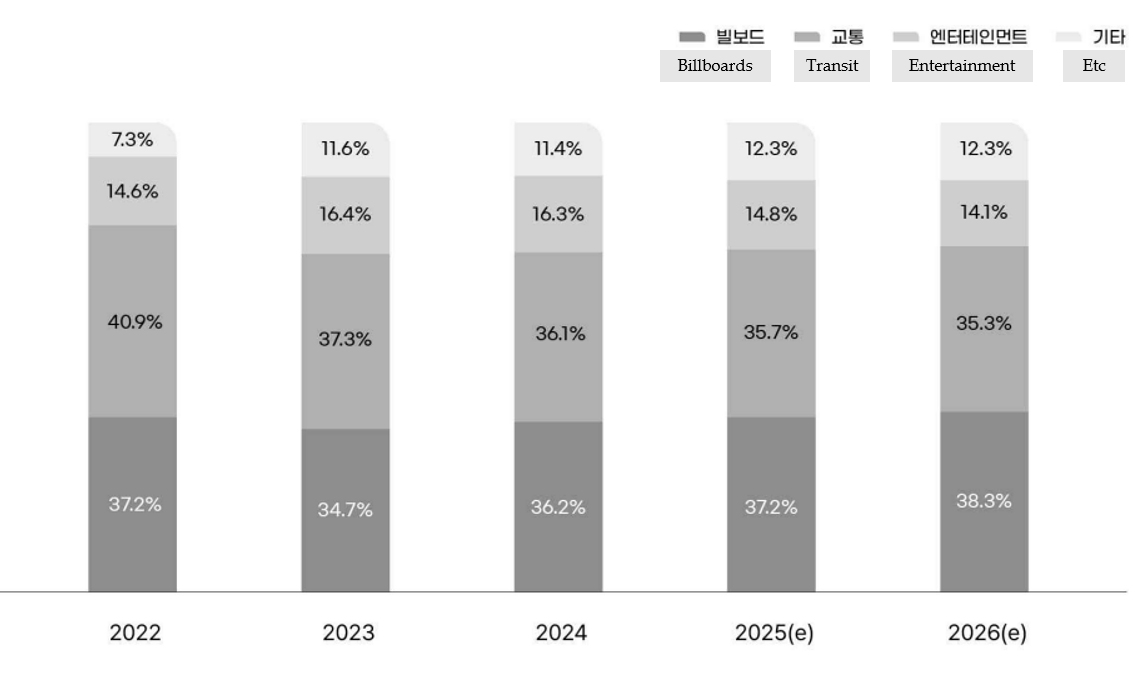

Online advertising dominated with a 59.0% share, followed by broadcasting at 18.8%, newspapers and magazines at 11.6%, and OOH at 7.4%, or KRW 1.26 trillion. Within OOH, traditional non-digital formats grew 2.4% to KRW 733.6 billion, while digital signage expanded faster, rising 4.2% to KRW 525.5 billion. This structural backdrop shaped the industry’s trajectory in 2025.

Against this market environment, 2025 marked a pivotal phase for South Korea’s OOH industry as it moved deeper into a multi-channel, multi-format era. With second-phase free display zones entering their second year, Seoul saw another wave of large-scale digital screens installed in Myeongdong and Gwanghwamun, following the earlier launch of Shinsegae Square. New public tenders accelerated the replacement of legacy analog inventory, while existing digital assets were upgraded with higher resolution, improved brightness, and more sophisticated operational systems. Newly introduced formats broadly categorized as digital signage became the most visible engine of market expansion.

A symbolic milestone came on April 1, when Digital Chosun Ilbo officially opened the K-VISION screen in Gwanghwamun. In the second half of the year, several additional large-format displays followed in quick succession. These developments signaled that major media groups and infrastructure operators increasingly view OOH not as a peripheral channel, but as an urban-scale platform for branding, information, and public-facing content.

The expansion, however, unfolded amid a challenging macro and political backdrop. Emergency governance measures, impeachment-related uncertainty, and broader global instability weighed on advertiser sentiment. Many OOH operators recorded year-on-year revenue declines despite the growth in physical inventory. Even so, continued site launches and high-profile openings helped stabilize market confidence in the latter half of the year.

New infrastructure played a key role. In July, a digital roadside billboard corridor along Olympic-daero began operations under the name Road Block. In August, KTX Seoul Station introduced a large-format digital installation branded Seoul Panorama. These additions increased overall capacity and attracted advertiser attention, contributing to quantitative growth even as the broader advertising cycle remained subdued. Within transit media, in-bus digital signage in Seoul gained clear momentum, with advertiser demand strengthening toward year-end and sales approaching near sell-out levels by December.

At the same time, 2025 saw renewed interest in large-format wall lighting advertising using print-based formats. For global luxury brands, securing share of voice on premium digital screens is strategically important, but multi-advertiser loops impose structural limits. Exposure gaps of 15 to 20 minutes are common, with as many as 20 advertisers rotating on a single screen. In this context, print-type wall lighting media, which can be reserved exclusively by one advertiser, re-emerged as an efficient alternative. Some luxury brands pursued strategies that secured 30% to 50% or more of available inventory, underscoring that intensity and exclusivity can matter as much as location.

As digital and analog formats increasingly coexist, measurement has become the industry’s main pressure point. The Korea Out of Home Advertising Center has been leading a standardization project for OOH effectiveness metrics, using areas around Gangnam Station and Busan Station as testbeds. In December 2025, the project’s findings were formally presented, positioning the year as a turning point toward standardized, integrated effectiveness data. With more than 40 operators acknowledging the need for shared definitions and frameworks, the initiative is widely expected to shape industry development in 2026.

Inventory composition is also shifting. As large street-level screens and wall-based lighting media increase, indoor formats such as Seoul subway advertising have lost share compared with the previous year. Advertiser demand for in-train ads remains weak, intensifying commercial pressure on station media operators.

Looking ahead, 2026 is set to bring further structural change. Additional build-outs in free OOH Advertising zones are expected, alongside major Seoul tenders for bus shelters in August and exterior bus advertising in December.

If large-scale digital conversion proceeds, transport media could become the next acceleration lane for OOH digitization. With discussions also under way around a designated OOH zone in Dongdaemun, the central question remains whether expanding inventory can translate into sustainable impact under constrained advertising budgets, and whether the market can balance growth with measurement, stability, and fair competition.

한국 최초 글로벌 옥외광고 뉴스레터

세계 옥외광고 뉴스를 편하게 이메일로 받아 보는 법!

![[신간도서] NEXT OOH](https://cdn.media.bluedot.so/bluedot.oohnews/2025/06/wr0mf3_202506030151.JPG)