South Korea Emerges as Top Destination for Chinese Outbound Travel, Overtaking Japan

South Korea has emerged as the leading destination for Chinese outbound travelers, surpassing Japan and signaling a broader reshaping of Northeast Asia’s tourism landscape amid shifting political and diplomatic dynamics.

According to a recent report by Chinese economic media outlet Caixin, international flights from mainland China to South Korea outnumbered those to Japan during the New Year holiday period, reflecting a clear change in travel demand. The analysis cited data from aviation data platform Flight Master and aviation consultancy CADAS.

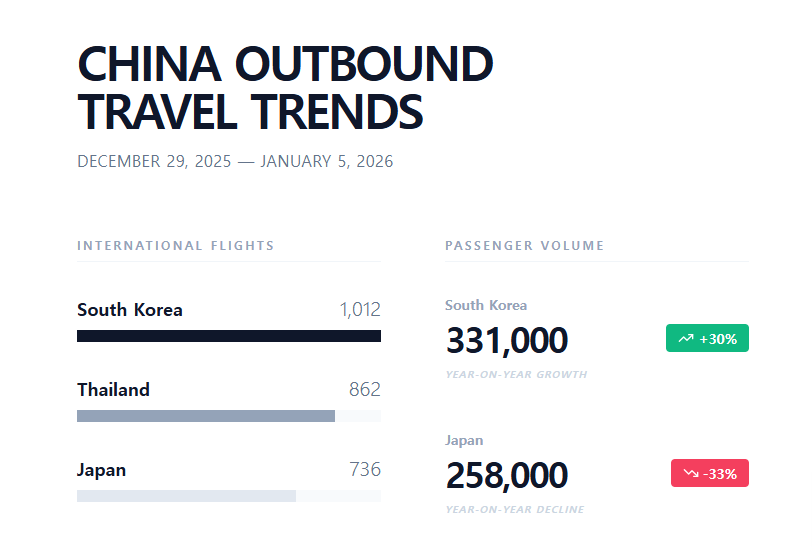

Between December 29, 2025 and January 4, 2026, a total of 1,012 international flights departed mainland China for South Korea, the highest among all overseas destinations. Thailand ranked second with 862 flights, while Japan followed in third place with 736 flights. Passenger volumes reinforced the same trend. From December 30 to January 5, the number of travelers flying between Chinese cities and South Korea rose 30% year-on-year to 331,000 passengers. In contrast, passenger traffic between China and Japan fell 33% from a year earlier to 258,000, according to CADAS estimates.

Industry observers attribute this divergence largely to political and diplomatic factors influencing travel sentiment and airline capacity. Strained China–Japan relations, compounded by lingering concerns over Japan’s release of treated wastewater from the Fukushima nuclear plant, have contributed to heightened safety anxieties and negative public sentiment among Chinese consumers. Against this backdrop, Chinese authorities have adopted a more cautious stance toward travel to Japan, prompting airlines to scale back capacity on Japan-bound routes.

South Korea, by comparison, has benefited from a more neutral positioning. While geopolitical issues remain present, they have not translated into explicit travel discouragement, allowing airlines and online travel platforms to expand flight supply and marketing activity. As a result, South Korea has become a more accessible and actively promoted destination for Chinese travelers seeking short-haul international trips.

Structural advantages have further strengthened South Korea’s appeal. Major coastal Chinese cities are just two to three hours away by air, supported by dense flight networks and frequent departures. Well-established tourism infrastructure—including Chinese-language services and widely accepted digital payment systems—reduces friction for both first-time travelers and repeat visitors. Cultural familiarity also plays a role, as K-pop, Korean dramas, beauty, and fashion continue to shape travel motivations, particularly among younger consumers.

Analysts note that, as Chinese travelers increasingly favor value-for-money, time-efficient destinations over long-haul trips to Europe or North America, South Korea’s proposition has become more compelling. Short travel times combined with high experiential returns have positioned the country as a practical yet aspirational choice.

If the redirection of Chinese outbound demand from Japan toward South Korea persists, the economic impact could be significant. Airports, downtown retail districts, duty-free stores, and luxury retailers stand to benefit as Chinese consumption approaches, or potentially exceeds, pre-pandemic levels. Categories with historically high Chinese spending—including cosmetics, luxury goods, fashion, and consumer electronics—are likely to see renewed momentum.

For global and regional brands, this shift is also reshaping marketing priorities. Increased emphasis on airport and urban digital out-of-home media, transit and shopping mall networks, and K-culture-linked experiential campaigns is expected, as advertisers seek to capture Chinese travelers at key touchpoints throughout their journeys in South Korea.

![[신간도서] NEXT OOH](https://cdn.media.bluedot.so/bluedot.oohnews/2025/06/wr0mf3_202506030151.JPG)

![[미국옥외광고협회] Out of Home Advertising Posts Record Third-Quarter Volume](https://cdn.media.bluedot.so/bluedot.oohnews/2024/11/2doqxb_202411220622.jpg)